It’s Money Time! – August 22, 2025

An adventure into the financial world

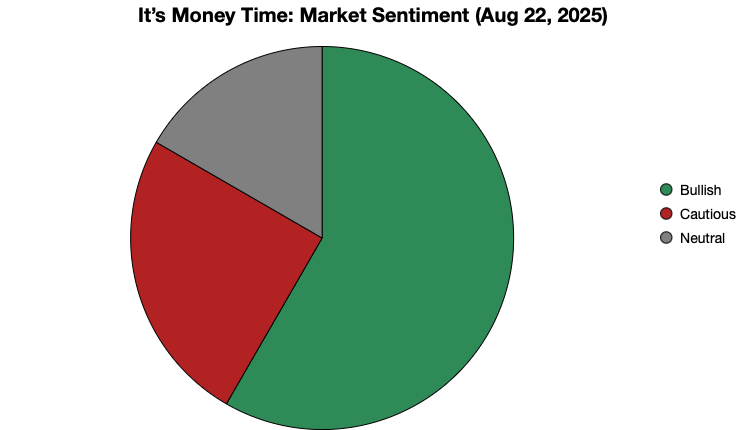

This chart summarizes the bullish (e.g., Dow, crypto, S&P), cautious (e.g., tariffs, retail), and neutral (e.g., autos, Walmart) leans of the stories, giving a quick visual of market momentum.

It’s Money Time! – August 22, 2025

Grook

Money talks, but never listens;

profits shine through broken systems.

Hello, Jim here.

This is something special I’ve been working on — a broad-first look at today’s financial world. The goal is to keep the stories varied, relevant, and easy to grok in seconds. Staying connected to the money side of the news matters, and this is my attempt to make that exercise both informative and enjoyable.

To keep the continuity (and the fun), Bob is along for the ride with his usual pithy comments — a little wit and insight in the margins. I hope you enjoy this new feature, and I’d love to hear whether you think it’s a good addition. I’ve built a process that makes putting these together quick and reliable, so you can expect them regularly.

Unifying Summary

Markets ripped on Powell’s Jackson Hole reset, rate-cut odds jumped, and risk appetite snapped back—especially in crypto. Meanwhile, tariffs are bleeding into retail pricing (Walmart), autos are bracing for 2026 sticker creep, and gold is quietly flexing as a hedge while technicians call higher on the S&P. The thread: policy whiplash meets profit gravity. Bob keeps the tone light; the numbers keep us honest.

1) Record Pop on Powell’s Finale

By Amalya Dubrovsky, Ines Ferré, Grace O’Donnell, Laura Bratton, Jenny McCall — Yahoo Finance

The Dow ripped to a record while the S&P 500 and Nasdaq surged as Powell’s Jackson Hole remarks nudged markets toward a September cut. Traders re-priced the glidepath: slower labor, easing inflation impulses, and a Fed that prefers an early trim to a later stumble.

Breadth improved and cyclicals caught a bid as “higher for not-much-longer” replaced “higher for longer.” Earnings sensitivity returns to center stage next week as the rally tests follow-through.

Bob: “Turns out the soft landing has a lounge.”

Leans: Bullish near-term risk; watch data-dependence.

2) Powell’s ‘Curious’ Labor Market

By Myles Udland — Yahoo Finance

Powell framed the jobs picture as “curious”—cooling openings and quits, pockets of slack, yet resilient payrolls. Translation: the Fed sees room to ease without stoking a wage spiral, if inflation keeps bending.

Markets heard “cut optionality.” The path now hinges on the next jobs + PCE prints; misfires revive volatility.

Bob: “The labor market is Schrödinger’s cat: tight until the data is opened.”

Leans: Constructively dovish; data-watch.

3) Dow’s First Record Close of 2025

By Stephen Wisnefski — Investopedia

https://www.investopedia.com/dow-jones-today-08222025-11795758

A relief rally turned into a statement close: the Dow jumped ~1.9% to a new high as rate-sensitives and old-economy names led. Powell’s hint at cuts unclogged bid-side liquidity that had been waiting out guidance risk.

Breadth and volume confirmed; the next test is whether tech leadership broadens or yields to value rotation.

Bob: “When the referee pockets the whistle, the offense runs wild.”

Leans: Bullish breadth > narrow megacap tape.

4) Crypto Catches a Tailwind

Investopedia

Bitcoin and crypto-adjacent equities spiked as lower-rate odds lifted long-duration risk. Spot ETF flows remain the transmission belt from TradFi skepticism to fee-collecting embrace.

The caution flag: liquidity chases narratives fastest on the way up and down. Position sizing is the adult in the room.

Bob: “First they ignore you, then they regulate you, then they rebalance into you.”

Leans: Bullish momentum; fragile floor.

5) September Cut ‘On the Table’

Investopedia

https://www.investopedia.com/fed-chair-powell-keeps-september-rate-cut-on-the-table-11795858

Plain English from the Chair: a September move is possible if inflation progress holds and labor cools further. Futures priced it in; term structure followed.

Cue the “one and see” debate: is it insurance or a mini-cycle? Markets prefer the former—until a print says otherwise.

Bob: “Doves don’t land—they taxi.”

Leans: Bullish for duration-sensitive equities.

6) July Minutes: Tariffs + Inflation Jitters

Investopedia

July’s no-cut came from tariff-linked inflation risk plus uneven disinflation. That’s the wrinkle: policy shocks can re-ignite prices even as demand cools.

If tariffs broaden (or deepen), the Fed’s easing cadence slows. Pricing power migrates to essentials; multiples compress at the margin.

Bob: “When policy raises your costs, ‘greedflation’ gets the blame.”

Leans: Cautious on staples/retail margins.

7) Back-to-School Squeeze

MarketWatch

Households are trimming BTS carts as tariffs and sticky prices nip discretionary spend. Retailers juggle shrink, freight, and promo calendars while trying not to torch margins.

Winners: value formats and private label. Losers: mid-market brands without pricing power or cult cachet.

Bob: “Kids want sneakers; parents want CPI to pass.”

Leans: Defensive retail > aspirational.

8) Dow Rips 846 Points

Kiplinger

Kiplinger’s tape read: a broad sentiment reset after Powell, with cyclicals and industrials confirming. The “higher-for-not-much-longer” meme found sponsorship across desks.

The sustainability test: earnings revisions vs. multiple expansion. A single cut can’t carry a quarter.

Bob: “Relief rallies are honest—they believe everything.”

Leans: Bullish if revisions don’t fade.

9) S&P 500: Elliott Wave Higher

Investing.com

Technicians see an ongoing Primary-V wave, implying higher targets if supports hold. Catalysts: a friendly Fed, tame core inflation, and a still-okay consumer.

Risk: overlaps that invalidate the count—plus headline shocks (tariffs, geopolitics). Stops matter.

Bob: “Wave 5: where conviction meets gravity.”

Leans: Bullish while levels hold.

10) Gold’s Quiet Flex

Investing.com

Gold firmed as a hedge against policy error and geopolitical noise; miners get leveraged upside if the metal holds gains. Central bank buying remains the slow, relentless bid.

Watch real yields: they’re the narrative boss for bullion. ETFs are the fast money, CBs the floor.

Bob: “Gold never defaulted, never crashed, never subtweeted.”

Leans: Bullish hedge; selective on miners.

11) Will 2026 Bring Car Sticker Shock?

By Chris Isidore — CNN Business

https://www.cnn.com/2025/08/22/business/car-prices-tariffs-new-model-year

Tariffs haven’t spiked prices—yet. Automakers have eaten costs, shuffled trims, and leaned on mix. The ’26 model year is the tell: room to absorb narrows, suppliers push through, and incentives can’t hide forever.

If price hikes land, expect stretchier loan terms, more leasing, and used-car substitution. Margins vs. volume is about to get real.

Bob: “You can finance anything—except gravity.”

Leans: Neutral OEMs; watch affordability drag.

12) Walmart Raises Prices, Traffic Holds

By Nathaniel Meyersohn — CNN Business

https://www.cnn.com/2025/08/21/business/walmart-stock-target

Walmart is passing along some tariff pressure—but basket counts and traffic remain sturdy as customers trade down into value. Scale and supply chain keep Bentonville nimble while mid-tier rivals feel the pinch.

Elasticity is the moat: small hikes at Walmart are survivable; similar hikes at weaker peers are deadly. Price leadership still matters.

Bob: “Everyday low prices beat everyday excuses.”

Leans: Bullish WMT relative; watch gross margin mix.

End Note

Policy moves set the mood; cash flows write the epilogue. When the Fed hints, markets sprint. When tariffs bite, consumers pivot. Keep the humor light, the stops tight, and the links real.

Quick Links

Stock market today: Dow jumps 800 points to record — https://finance.yahoo.com/news/live/stock-market-today-dow-jumps-800-points-to-record-sp-500-nasdaq-soar-as-powells-jackson-hole-finale-fuels-bets-on-september-rate-cut-200110990.html

Powell’s Jackson Hole speech and the ‘curious’ labor market — https://finance.yahoo.com/news/powells-jackson-hole-speech-turns-feds-focus-toward-curious-labor-market-172246057.html

Dow Jones Today (Investopedia wrap) — https://www.investopedia.com/dow-jones-today-08222025-11795758

Crypto stocks surge on cut hint — https://www.investopedia.com/bitcoin-and-crypto-stocks-surge-as-powell-rate-cut-hint-revives-risk-appetite-11795898

Powell keeps September cut on the table — https://www.investopedia.com/fed-chair-powell-keeps-september-rate-cut-on-the-table-11795858

July Fed minutes: tariffs & inflation worries — https://www.investopedia.com/tariff-inflation-fears-led-fed-to-avoid-rate-cut-in-july-meeting-minutes-show-11794671

Back-to-school spending squeeze — https://www.marketwatch.com/story/inflation-and-tariffs-are-hitting-back-to-school-spending-the-stock-market-could-be-tested-170833bc?mod=home_invest

Dow rips 846 points (Kiplinger) — https://www.kiplinger.com/investing/stocks/dow-rips-846-points-to-new-all-time-high-stock-market-today

S&P 500 Elliott Wave higher — https://www.investing.com/analysis/sp-500-elliott-wave-count-suggests-ongoing-primaryv-with-higher-targets-ahead-200665774

Gold’s shine & miners to watch — https://www.investing.com/analysis/gold-shines-amid-feds-dilemma-top-mining-stocks-to-watch-200665772

2026 auto prices & tariffs — https://www.cnn.com/2025/08/22/business/car-prices-tariffs-new-model-year

Walmart raises prices, traffic holds — https://www.cnn.com/2025/08/21/business/walmart-stock-target