THE INFLATION THAT NEVER REVERSES

Why Prices Only Move One Direction — and What the 50-Year Multiples Really Reveal

THE INFLATION THAT NEVER REVERSES

Why Prices Only Move One Direction — and What the 50-Year Multiples Really Reveal

By Jim Reynolds | www.reynolds.com

I. A Half-Century Pattern We Pretend Not to See

Civilizations often camouflage their most predictable failures behind technical language. Inflation is one of them.

For fifty years, Americans have been told that the cost of living “fluctuates,” “adjusts,” “levels,” or “responds to market conditions.”

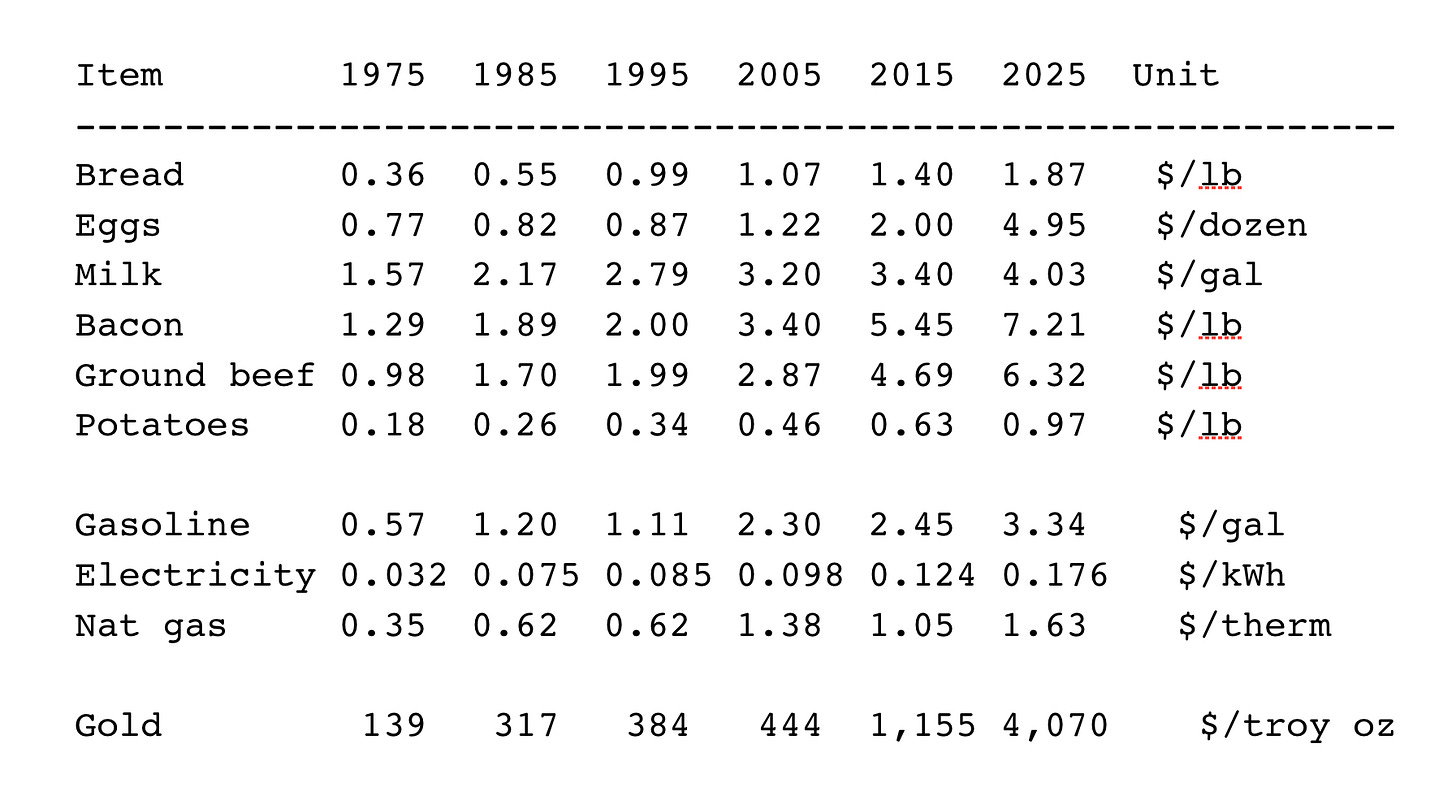

Table: Prices by decade: 1975-2025. Note the starting and ending values of each row.

But the table above tells the unmannered truth:

Prices do not fluctuate.

They rise.

Always.

Across food, fuel, shelter, and daily essentials, the multiple is similar: a silent climb, steady and irreversible. Whether the item is grown, mined, harvested, refined, or metered, the direction never changes.

The American household lives in a world where goods may rise quickly or slowly — but never retreat.

Inflation is not episodic.

It is cumulative.

Bob’s instinct would phrase it more tersely: “Gravity works on everything—except prices.”

II. The 1975→2025 Multiples: A Map of Real Life

Here are the hard numbers showing how much everything has gone up over 50 years:

Bread: 5.2×

Eggs: 6.4×

Milk: 2.6×

Bacon: 5.6×

Ground Beef: 6.5×

Potatoes: 5.4×

Gasoline: 5.9×

Electricity: 5.5×

Natural Gas: 4.7×

Gold: 29.3×

These figures—so ordinary at first glance—form one of the clearest fingerprints of modern American economic life. They describe not merely price changes, but the continuum of a society adjusting quietly to a cost structure that never yields.

III. The Common Thread: A Civilization Drifting Upward in Cost

Nearly all daily necessities converge in the same band:

a five- to six-fold increase over fifty years.

This is not coincidence; it is the authentic signature of long-run inflation:

The money supply expands.

The currency weakens.

Regulation intensifies.

Labor costs accumulate.

Energy, transport, and compliance become embedded overhead.

Each year’s rise becomes the next year’s baseline.

Each baseline becomes the next decade’s foundation.

Prices do not retreat because the forces that lifted them do not retreat.

It could be said that inflation is the rare public policy whose errors compound without confession.

IV. Why Some Items Rise Faster — and What That Reveals

While the overall arc is uniform, the rates tell a deeper story.

1. Milk (2.6×): The Outlier of Restraint

Milk is the closest thing America has to a regulated, industrialized constant:

high productivity gains

federal price supports

political protection

retail chains using it as a loss-leader

It behaves less like a commodity and more like a semi-managed public utility.

2. Eggs, Bacon, Ground Beef (5.6×–6.5×): The True Cost of Protein

Protein inflation leads food inflation.

Livestock is expensive. Regulation is heavy. Feed is volatile. Disease cycles oscillate.

And demand never weakens.

These items reflect the real cost pressure on the American table—the unvarnished, un-subsidized cost of keeping a household fed.

3. Gasoline, Electricity, Natural Gas (4.7×–5.9×): Energy’s Compromise with Reality

Energy rises at the same general pace as food, but benefits from:

technological efficiency

deregulation (in earlier eras)

the shale revolution

fierce competition

Even then, it never returns to earlier levels.

Energy, once repriced, stays repriced.

Commodities in this category demonstrate the ratchet principle of modern governance: every click forward is permanent.

V. Gold: A Category Apart

Gold’s 29× multiple stands outside the pattern for a reason:

Gold does not measure the cost of living.

It measures the cost of the dollar.

Its rise is not the inflation of bread and gasoline; it is the inflation of the currency itself.

Gold is the barometer that cannot be cajoled into optimism.

It records the quiet, compounding dilution that the CPI glosses over.

Where groceries tell you how families are doing, gold tells you how the Treasury is doing.

The difference between 5× and 29× is the difference between the consumer’s world and the dollar’s world.

VI. Why Prices Never Go Down

There is a structural truth economists rarely admit:

Inflation is not a weather event. It is a policy.

And policy rarely reverses itself.

Prices do not drop because:

wages never reset downward

regulatory burdens never unwind

supply chains never fully “un-cost” themselves

governments never shrink (well, almost never)

currency supply never contracts

political incentives never permit deflation

The American cost structure is a staircase with no descending steps.

Every rise is permanent.

Every floor becomes the new foundation for the next climb.

Inflation is not a cycle.

It is an accumulation.

VII. What the Multiples Ultimately Reveal

Look again at the table:

everyday essentials—food, fuel, power—drift upward together with metronomic discipline.

Only the magnitude varies; the direction does not.

This is the economic reality Americans inhabit:

A country where the dollar weakens steadily, costs rise permanently, and citizens adjust gradually, almost ritualistically, to a standard of living that creeps higher in price without rising in quality.

Identity politics may confuse, legislation may distract, commentary may swirl—

but inflation is the one force that never lies.

Bob’s instinct would summarize the matter dryly: “You can debate policy. You can’t debate the receipt.”

VIII. Closing Reflection

Inflation is the quiet architect of a nation’s lived experience.

It shapes expectations, constrains futures, and slowly redraws the boundaries of what ordinary life costs.

The table above is not simply a list of price multiples; it is a half-century biography of American purchasing power.

Prices never go down because our system is not built for them to go down.

It only climbs, adjusts, absorbs, and climbs again.

And in that climb, the country learns—repeatedly and without ceremony—the oldest lesson of monetary decay:

Everything costs more.

Nothing costs less.

And the bill always arrives.

———————————-

Sources used:

BLS Average Price Series (APU) — food items

EIA — gasoline, electricity, natural gas

LBMA/CME — gold historical spot

All values cross-verifiable