THE 50-YEAR MIRACLE NO ONE TEACHES YOU

Why Starting Early (Even Small) Becomes Life-Saving Wealth Later

THE 50-YEAR MIRACLE NO ONE TEACHES YOU

Why Starting Early (Even Small) Becomes Life-Saving Wealth Later

By Jim Reynolds | www.reynolds.com

Most financial advice given to young adults is abstract, preachy, or useless.

But there is one principle — one mathematical truth — that is so powerful, so predictable, and so life-changing that it should be taught in every 10th grade classroom:

Money saved in your 20s turns into wealth in your 60s.

Not because you’re lucky.

Not because you’re brilliant.

But because math doesn’t care — it just compounds.

Let me show you what this means.

A Teacher Who Became an Engineer

Picture a college education financed not by loans or parents, but by sweat:

summer jobs, work-study shifts, and a beat-up bicycle that always got you to class on time. Add a tiny UC scholarship that covered tuition, and subtract everything luxurious. Housing? A shared studio with peeling linoleum. Meals? Potato soup, canned beans, PB&J — the $1-a-day survival kit of a student determined not to ask anyone for a dime.

That student became a public school teacher in the 1970s.

Not wealthy.

Not connected.

Not “privileged” in any modern sense.

Just a kid teaching other kids multiplication tables and how to sing in tune — for $10–14k a year.

He changed careers in the mid-1980s, paid for more schooling, and became a software engineer.

Better hours, better pay, a mortgage, a family — a regular American life built one stubborn year at a time.

Here’s the hinge of the whole story:

Every single year, he paid his Social Security taxes.

Every single year, his employer matched those taxes.

And every single year, that combined money vanished into Washington, never to return.

Now imagine the alternate universe — the one this essay is about.

Imagine if instead of surrendering that money to the government, he invested it in a simple S&P 500 index fund.

No stock picking.

No timing the market.

No day-trading, no leverage, no cleverness.

Just steady deposits and a willingness to let time do its work.

The result is so staggering it borders on the obscene.

So staggering that if every American understood it, half of Washington’s excuses would evaporate overnight.

Which is exactly why it’s never taught.

The Quiet Power of Starting Early

Even small contributions in your early 20s — especially if your employer matches — snowball into life-changing money over 40–50 years.

Every dollar saved at 22 quietly multiplies into $14–18 by 67.

Every dollar saved at 30 becomes $8–10.

Every dollar saved in your 40s becomes $4–5.

Not because the amounts are big.

Because the time is long.

The “Retirement Shock” No One Expects

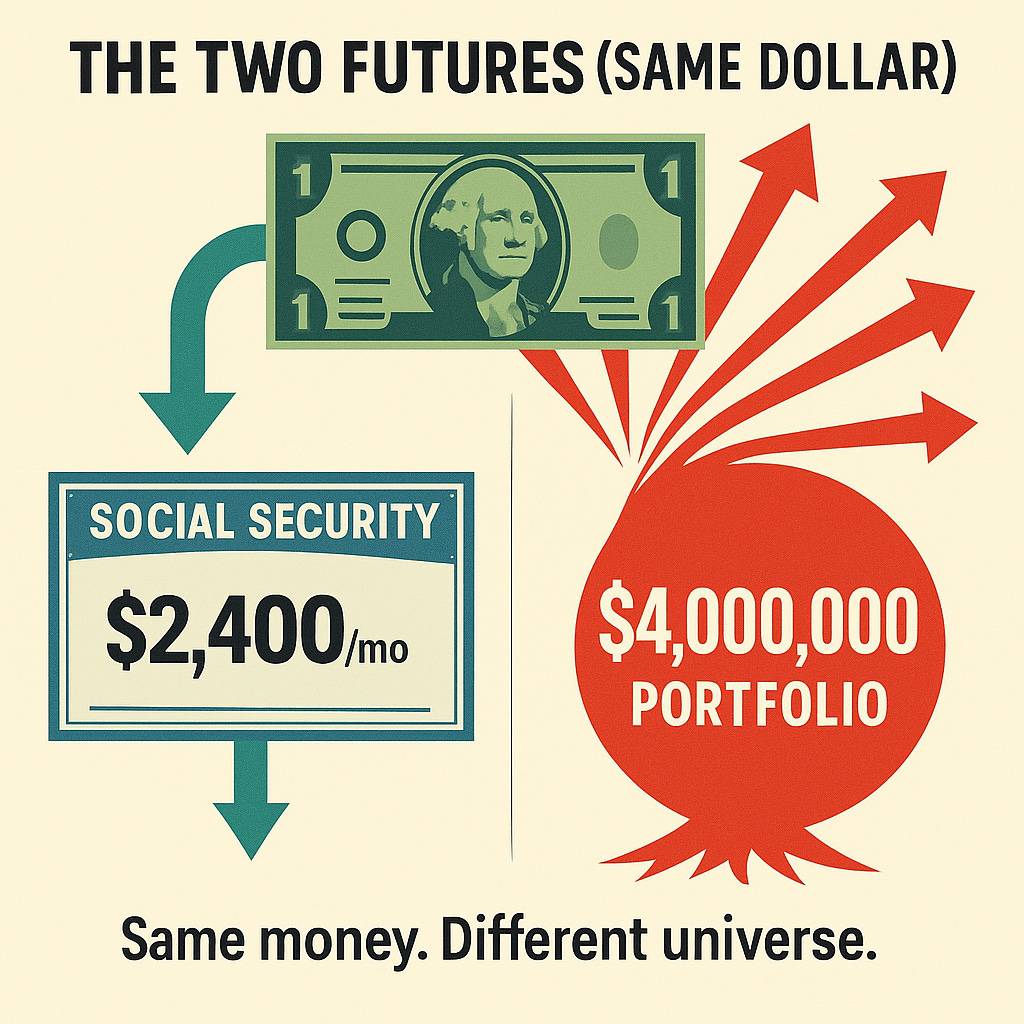

Imagine retiring at 70 with a portfolio worth $4 million — a completely normal outcome for someone who invested modestly over a long life — at the same rate we are forced to contribute to social security.

So, instead of receiving $2,400 a month from SSA, you have a nest egg worth $4M. Again, the same money contributed — just an entirely different result.

With the drop-dead simple S&P investment strategy, you may choose to withdraw $160,000 a year — twice the median household income.

Most people assume:

“If I spend $160,000 a year, that money will run out.”

Wrong.

With a reasonable 6% return, your balance increases every year.

Age 70: $4.0 million

Age 80: $5.2 million

Age 90: $7.2 million

Let that sink in:

You withdrew $3.2 million…

And ended up richer than when you retired.

This is the miracle no school teaches.

The missing chapter that would change every young life.

WHAT LIBERAL INSTITUTIONS HAVE CONNED YOU INTO

While you were young enough to let time and compound interest make you wealthy, the liberal institutions you trusted pulled a psychological smash-and-grab on your future.

Instead of teaching you the one iron law of prosperity — make money work for you — they shoved you into the worst financial trap ever engineered by people who pretend to care about you.

They told you to borrow your way into success.

And you believed them.

Instead of urging you to invest early — when every dollar has fifty years to multiply — they told you to take out loans so outrageous they would make a Vegas bookie blush.

Debt that compounds against you. Debt that grows while you sleep. Debt that metastasizes if you miss a payment. Debt that behaves like a financial tumor.

And while the debt grows, they smile and call it “opportunity.”

It wasn’t an opportunity.

It wasn’t an investment.

It was a harvest.

They didn’t advise you. They harvested you.

Think about it:

Who gave you this advice?

School counselors. University administrators. Politicians. The legacy press. The whole cathedral.

Every one of them collected their paycheck upfront.

They didn’t care if you succeeded.

They didn’t care if the debt crushed you.

They just needed your signature — your future earnings — your life energy.

And when the bill came due, they acted shocked — shocked! — that people were drowning.

They conned you into believing debt was freedom.

They conned you into believing loans were opportunity.

They conned you into believing that being shackled for decades was “progress.”

Name one other industry where the advice cripples the customer for life.

Those people should be in jail.

But instead, they sit on panels on TV preaching about “equity,” protected by pensions and guarantees you will never see.

You didn’t fail.

They betrayed you.

THE OLDER “YOU” KNOWS SOMETHING YOU DON’T

If you’re young, hear this from someone 40–50 years ahead of you:

Future You is real.

Future You is coming.

Future You needs your help.

The $200 you invest today isn’t a sacrifice.

It’s a message in a bottle — addressed to the older you who needs it.

And when that day comes, he won’t just thank you.

He’ll bless you.

💬

POCKET GROOK — “FUTURE YOU”

Save a little when you’re young,

Much later, you’ll be glad it’s done.

A dollar now, though small it seems,

Becomes the life you hoped in dreams.

Time is quiet, interest loud—

Small seeds grow forests you feel proud.

Guard your freedom, start with two—

You’re not just saving.

You’re saving you.

✉️

A LETTER FROM “FUTURE YOU”

Hey kid,

I know you don’t think about me much.

Why would you? You’re 22. Life is loud. Rent is rude. Money is tight.

But listen:

Every dollar you save now is going to feel like a hundred dollars to me later.

Not because I’m greedy — because life gets expensive when you’re older.

And because time does magic you can’t see from where you’re standing.

I don’t need you to be perfect.

I don’t need you to be rich.

I need you to start.

Just a little.

Just often.

Just enough that when life eventually tests me — and it will —

you gave me the tools to pass the test.

I’m proud of you already.

Just try to be proud of me, too.

— Future You

Your Retirement Drawdown Simulation (Age 70–90)

In a hypothetical world where you put your money directly into the S&P index rather than Social Security.

Note: I gave AI my complete SSA history so it could calculate the differences in investing “strategies”.

At age 70:

Starting balance: $4,000,000

Yearly withdrawal: $160,000

Growth rate in retirement: 6%

Result: Your money never goes down—it increases every single year.

At age 90, you have almost $7.2 million left.

That’s not a typo.

Balance After Withdrawal Each Year

Age 70: $4,080,000

Age 75: $4,558,025

Age 80: $5,197,731

Age 85: $6,053,802

Age 90: $7,199,418

You withdrew $3.2 million and still ended up $3.2 million richer than when you started.

This is the entire argument in one sentence:

Your portfolio grows faster than you can spend it.

And that’s the point this essay drives home:

The time value of money is timeless.

Sent this to all “ my grandkids. One graduated from college 2 years ago and is investing. The others are still

In school. I’m paying their tuitions. Trying to get them off to a good financial start.

Jim,

Thank you for another great article. I too have forward this to my three children.